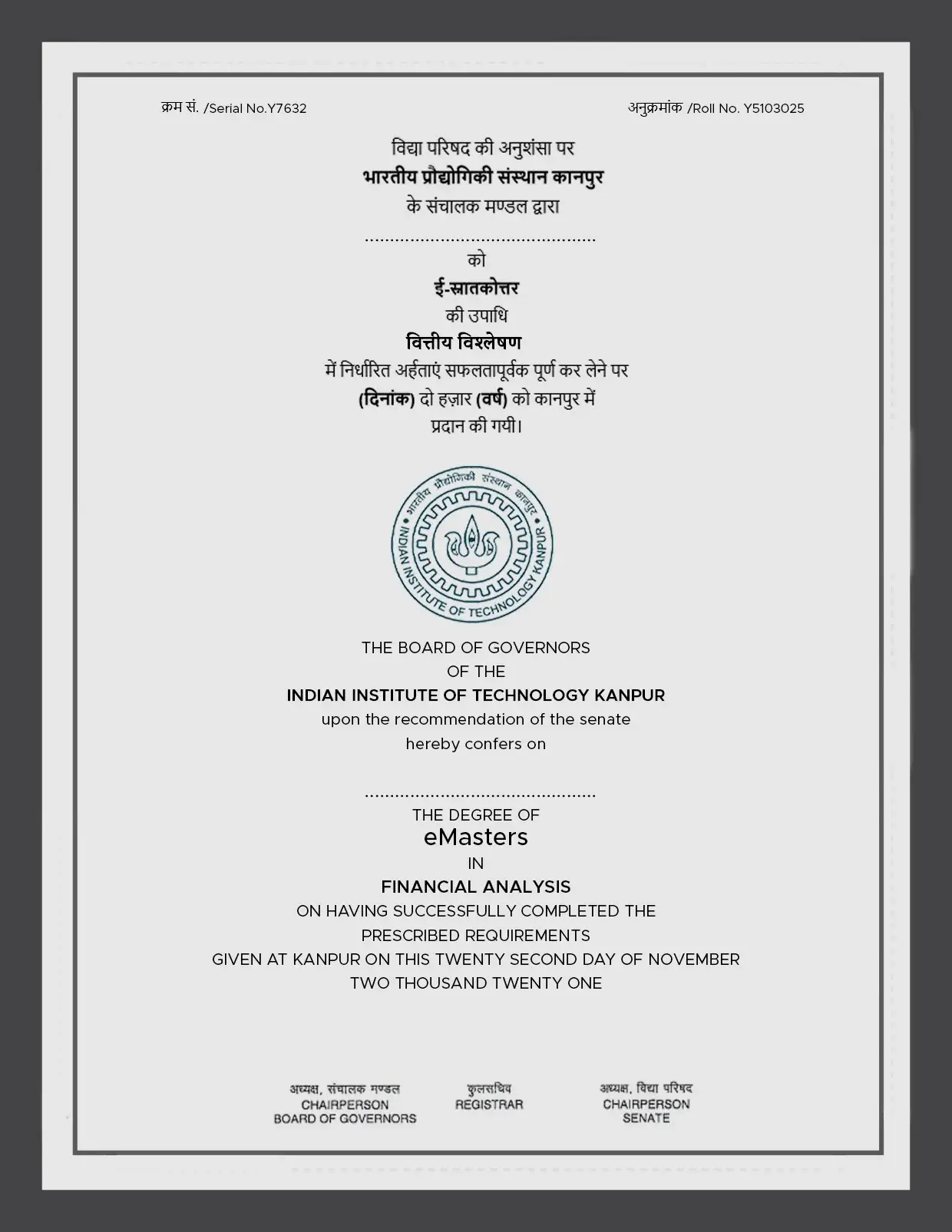

e-Masters in Financial Analysis

Accelerate Your Career with Masters in Financial Analysis:

Where Data Meets Strategy

- No GATE Score required

- IIT Kanpur Alumni Status

* Selection test differs for every programme

Previously named as Economics, Finance and Data Analysis. The e-Masters in Financial Analysis program at IIT Kanpur is designed for students seeking a comprehensive education in the fields of economics, finance, and data analysis. The program is tailored for individuals who wish to pursue a career in these areas, or for those who are interested in enhancing their existing skills.

Program offers a unique blend of economic theories, financial concepts and data analysis tools to prepare students for the dynamic and constantly changing business environment. The program provides a deep understanding of micro and macroeconomic principles, financial markets, investment analysis, financial risk management, and data analysis. The program is ideal for individuals who have a background in economics, finance or related fields, or for those who wish to gain a deeper understanding of these areas. It is also suitable for professionals looking to enhance their careers through further education, as the program is offered online.

The Masters in Financial Analysis program at IIT Kanpur is designed to provide students with the skills and knowledge necessary to succeed in the competitive world of economics, finance and data analysis. The curriculum is designed to provide students with the latest tools and techniques, as well as a thorough understanding of the economic and financial concepts that shape our world.

In conclusion, the e-Masters in Financial Analysis program offered at IIT Kanpur is a comprehensive program that provides students with a unique blend of economic, financial and data analysis skills. It is a great opportunity for individuals who are seeking a challenging and rewarding career in these fields, or for those who wish to enhance their existing skills.

Meet our distinguished faculty, accomplished experts in economics, finance, and policy analysis, dedicated to shaping the policy leaders of tomorrow

Vimal Kumar

Vimal Kumar Bikramaditya Datta

Bikramaditya Datta Wasim Ahmad

Wasim Ahmad Aditya Jagannatham

Aditya Jagannatham Sohini Sahu

Sohini Sahu Sounak Thakur

Sounak Thakur Anurag Singh

Anurag Singh Abhijeet Chandra

Abhijeet Chandra Dr. Ajay Kumar

Dr. Ajay KumarGet ready to dive into the latest theories & techniques in Financial Analysis. Our well researched curriculum will equip you with the skills you need to succeed.

Modules

eMasters in Financial Analysis consist of Core (C), Specialization (S), and Electives (E) modules and Projects (P). Participants are given flexibility in deciding on electives and projects and follow the 6C + 3S + 2E + P structure.

Live Interactive Sessions

Live Interactive Sessions Projects

Projects  Online Examination

Online Examination Campus Visit

Campus Visit

Application fee ₹1500 (to be paid during application submission)

Application fee ₹1500 (to be paid during application submission)

Fee structure for candidates opting to complete the program in 1 year.

| Details | Amount |

|---|---|

| Registration Fee To be paid within 1 week of selection |

₹40,000 |

| Admission Fee To be paid to complete enrollment |

₹1,60,000 |

| Module Fee To be paid at the beginning of every quarter based on no. of modules selected (Total 12 Modules) |

₹5,40,000 ₹45,000 per module |

| Quarter Fee* To be paid at the beginning of every quarter |

₹60,000 ₹15,000 per quarter |

| Total Fee | ₹8,00,000 |

*For every additional quarter, fees of Rs 15,000 will be applicable.

For Example

Candidates opting to complete the program in 5 quarters need to pay an additional fee of ₹15,000

Candidates opting to complete the program in 11 quarters need to pay an additional fee of ₹1,05,000

All other fees remain the same.

Fees paid are non-refundable(after a certain time period) and non-transferable.

Established in 1959 by the Government of India, Indian Institute of Technology Kanpur (IIT Kanpur) is a globally acclaimed university for world-class education and research in science, engineering, management and humanities. We aim to provide leadership in technological innovation for the growth of India.

The eMasters Program by IIT Kanpur will be delivered on iPearl.ai, a State-of-the-Art digital learning platform, powered by TalentSprint. iPearl.ai, highly rated for its user experience, is a direct-to-device platform that works seamlessly on any internet-connected device and provides a single-sign on experience for all your learning needs including recorded videos, reading material, live interactive sessions, assignments, quizzes, discussion forums, virtual lounges and more.

The curriculum for eMasters in Financial Analysis comprises Core (C), Specialization (S), and Electives (E) modules and Projects (P). Participants are given flexibility in deciding on electives and projects and follow the 6C + 3S + 2E + P structure.