e-Masters in Financial Technology &

Management Overview

The e-Masters in Financial Technology & Management program is an innovative and dynamic program that combines the latest advances in financial technology with traditional financial management principles. This masters degree in Fintech offers working professionals the unique opportunity to study the impact of technology on finance and the financial services industry, as well as the development and management of technology-driven financial products and services.

The program covers a wide range of topics, including financial innovation, digital transformation, risk management, and data analytics. Through a combination of online coursework, case studies, and practical projects, students will gain hands-on experience in the development and management of technology-driven financial products and services.

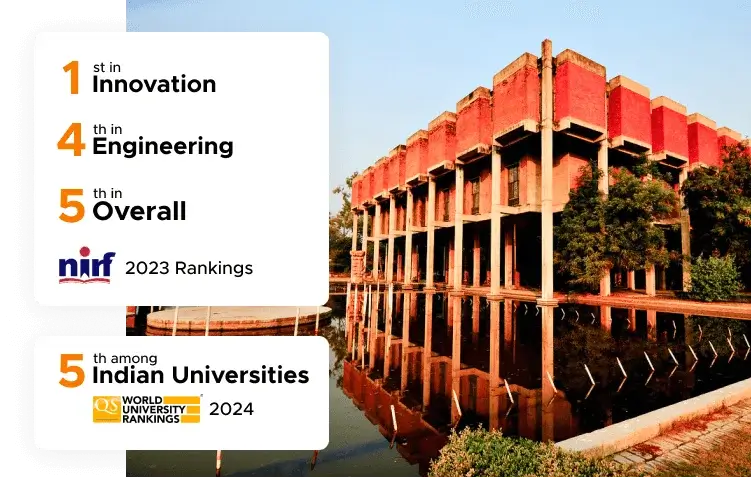

The Masters in Financial Technology & Management program is designed for individuals who are seeking to further their careers in the financial services industry, technology startups, or consulting firms. Offered by the Department of Management Sciences (DoMS), formerly known as Department of Industrial and Management Engineering (IME), The program provides a comprehensive education in financial technology and management, preparing professionals for leadership roles in the industry. The faculty consists of leading experts in the field of financial technology and management, offering the opportunity to learn from experienced professionals with a wealth of knowledge and practical experience. The program is flexible and allows working professionals to study at their own pace, making it an ideal choice for those who are looking to balance their education with their professional and personal commitments.

In conclusion, the e-Masters in Financial Technology & Management program provides a unique and comprehensive education in the rapidly evolving field of financial technology and management. Graduates of this program will be well-prepared to succeed in a fast-paced, technology-driven industry and will have the skills and knowledge necessary to pursue leadership roles in the industry.

Graduation Ceremony at IIT Kanpur Campus

Live Interactive Sessions & Guest Lectures

Live Interactive Sessions & Guest Lectures Case study-based Learning

Case study-based Learning Projects

Projects  Periodic Assessments

Periodic Assessments Online Examination

Online Examination Campus Visit

Campus Visit

Education loan avail from

Education loan avail from

Research Expertise: Decision Theory, Behavioral Operations Management, Supply Chain Contracts, Optimization in Operations Management, Sustainable Operations, Healthcare Operations