Energy Sustainability: An Overview

Module 1: Foundations of Economics and Finance

- Develop a firm theoretical understanding of economic and finance concepts, their significance and their application in equity and derivatives markets.

Module 2: Introduction to Derivative Contracts

- Gain an in-depth insight into the pricing and valuation of derivative contracts and the different commodities and financial instruments - Forward, Futures, and Options.

Module 3: Quantitative Methods in R and Python

- Learn to analyze data using different quantitative methods - Linear Regression, Time Series Analysis, Panel Data Modelling, Limited Dependent Variable Model, and Simulation Methods. In addition, learn about R and Python concepts and their application in implementing financial models.

Module 4: Security Analysis and Portfolio Management

- Understand the concept of Portfolio Management and Asset Pricing Models. Learn about formulating investment strategies, including valuation of equity and fixed income securities. In addition, know about Security Analysis and Valuation, assessing return anomalies to timely boost market efficiency.

Module 5: ML in Financial Modeling

- Understand the big data problems in finance. Learn about Machine Learning (ML) and the different models used for applying ML in quantitative finance. Also, get introduced to ML applications in risk management.

Module 6: Treasury and Credit Risk Management

- Identify different types of risks faced by firms. Learn about the advanced treatments of varying risk management practices and credit risk in derivatives products.

Module 7: Advanced Derivative Contracts and Pricing

- Gain a detailed understanding of derivatives contracts with a balanced exposure to futures and options. Besides, learning about the valuations of forwards and futures from the perspectives of price discovery and risk management.

Module 8: Blockchain Applications in Finance

- An introductory module that provides an overview of blockchain technology and its applications. Supported by illustrations and use-cases for effective learnings.

Module 9: Technical Analysis in Finance

- Learn about various methods of detecting and identifying the trends and develop trading strategies.

Module 10: Advanced Financial Modeling

- Get an overview of financial modeling in equity and derivatives markets. Explore the tools and techniques required for analyzing the financial data of different frequencies.

Projects

Faiz Hamid

Faiz Hamid Subhankar Mukherjee

Subhankar Mukherjee Aparajita Ojha

Aparajita Ojha Live Interactive Sessions

Live Interactive Sessions Projects

Projects  Online Examination

Online Examination Campus Visit

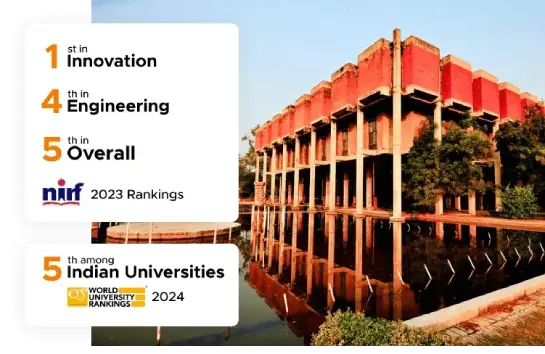

Campus Visit

Education loan avail from

Education loan avail from